Essential tools for fintech startups

Fintech startups, unlike ‘regular’ startups, must comply with various regulations that aim to prevent fraud and ensure data security. In this article, you will learn how to launch a fintech startup faster thanks to low-code and no-code tools.

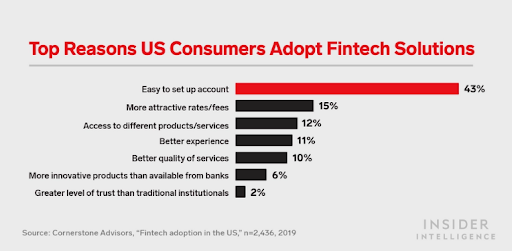

Fintech startups are booming, and the pandemic has only accelerated this process. Consumers are increasingly interested in online banking, payment solutions, and online currency exchange platforms, and they claim the simplicity of using these solutions is the top reason behind choosing them.

However, unlike ‘regular’ startups, those operating in financial services must comply with various regulations that aim to prevent fraud and ensure data security. Emerging startup owners must be aware that building a fintech startup is a lengthy process, and time is money, especially in such a competitive environment. In this article, you will learn how to launch a fintech startup faster thanks to low-code and no-code tools.

Even skeptical developers tend to agree that using third-party providers has numerous advantages, and the speed of launching new products is one of the top ones. At Forest Admin, we are experts in internal tools and we know that maintaining an admin panel can take up to 30% of development time, which should rather be spent on a shiny customer-facing app. We believe that it is also true in other areas — and because we work with fintech startups and scaleups on a daily basis, we decided to present useful third-party solutions that address the unique needs of financial services companies, such as KYC processes, payment gateways, or eSignature solutions.

Tools for payment solutions

Unless your plan is to build a payment gateway or another solution that facilitates making various transactions, you will most likely need one. Customers expect online payment solutions to be easy to use, secure, and trustworthy. Products like Stripe, Melio, or Klarna address these needs and are easy to integrate with other apps.

Tools for Open Banking

Open Banking, also known as “open bank data”, is a banking practice that allows the networking of accounts and third-party financial service providers (such as fintech startups). It gives them open and secure access to transactional data, consumer banking, and other financial information from banks and other financial institutions. The process is done through APIs, and it is becoming the major source of innovation in financial services.

An example of Open Banking services is a Latvian startup Nordigen, a freemium banking data platform connected to over 1000 banks in Europe.

Tools for electronic signature

It may not be the case of every fintech startup, but when it comes to companies dealing with enterprise customers and deals, a reliable and trustworthy electronic signature solution is a must-have. They are legally binding, easy-to-use, and much more efficient than printing, signing, and scanning documents. Two great examples are YouSign, a successful European provider, and DocuSign, which is leading the American market.

Tools for localization

It is safe to say that most startups sooner or later want to expand internationally and to provide services in many local languages. Localization is a must, especially in the B2C sector, but the concept is still often confused with translation. The definition of localization is the process of adapting content, products, and services to specific local markets.

This might be particularly important for fintech startups. Entering foreign markets requires not only translating the app into the local language, but also understanding preferred payment methods, the level of trust towards digital banking, visual and UX preferences, and so on. When in Rome, do as the Romans do.

Lokalise is a service that provides tools to automate, integrate, and better manage your localization. It is used, among others, by Revolut, one of the most popular fintech companies today.

Tools for efficient KYC process and fraud management

KYC, Know Your Customer, is a regulatory requirement for all financial institutions, including fintech startups. Traditionally, it has been an entirely offline process, with customers visiting banks and preventing their IDs and other documents. However, the growing number of financial services operating in the digital sphere need processes that are 100% online. Basically, thanks to KYC processes, financial institutions can find out:

- If people they talk to are really those they claim to be.

- If they appear in any criminal databases.

- If they are accepted as valid users of the platform.

KYC can be done in various ways, and each institution has its own processes. What they all have in common is the need for an internal tool that allows customer-facing teams to verify data. Many fintech institutions have chosen Forest Admin to do that — one of which is Spendesk, the all-in-one spend management solution that has raised a €100M Series C in mid-2021. Here is what they say about Forest Admin:

It took me literally 1 min to set up my KYC process on Forest Admin and I don’t have to perform old SQL queries into the raw database to access customers’ information.

Maylis Amram, Customer Success Manager at Spendesk

However, a successful KYC process is just the beginning. Once users are onboarded, fintech companies must make sure they comply with government regulations that aim to prevent fraud and money laundering. An internal tool solution like Forest Admin meets these needs just as well.

Forest Admin has helped a lot when it comes to identifying and processing suspicious transactions. Their unique architecture allows our fraud prevention team to approve or reject a transaction without ever switching interface.

Germain Michou-Tonning, Director of Operations at Qonto, one of the biggest French neobanks.

🌲🌲🌲

Are you a new fintech startup looking for the right tools to get started in the market? Or maybe an already existing company looking for an internal tool that would help you grow your business?